At a Glance: Is Your Money on the Right Side of the River?

People often think there are only two camps or choices to investing. The first camp is the long-only Big Box choice where your money is always invested in the market and never gets taken out. This is where most people live. Some however, wake up and say, “oh my gosh, there must be something better…

The Rosetta Stone of Investing Infographic

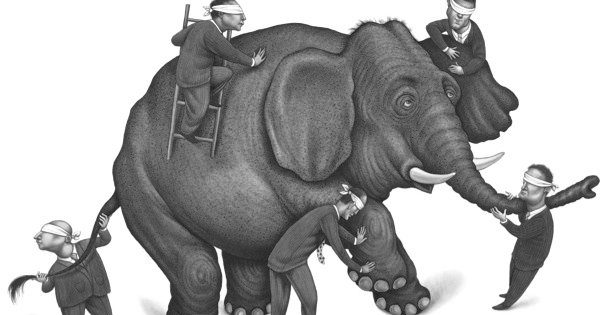

Investors have been taught that there are only two camps to investing: (1) The long-only Big Box camp where an investor’s money is always invested in the market and (2) the “pick of the month” newsletter camp. This image is about camp #3. A camp that is so obvious and simple, most investors can’t even…

What’s The Missing X-Factor in Your Investment Strategy?

The key to an effective investment strategy is to set expectations and then wait to be ‘surprised.’ And the ‘surprise’ is almost always hiding behind the same four words. Four unnoticed words that aren’t heard even when people speak them. Common words. Three of the four words are even single syllable. They’re not latin or…

At a Glance: This Doesn’t Make Sense

Sometimes you may see something that happens, and you might think to yourself that it really doesn’t make sense. But the reality is, is that it does make sense. It’s just that we often aren’t able to see the reason for why the way things happen until after they happen. This is why when stocks…

From 50% to 215% With Two Questions

The Obvious is Hidden One of the hardest things is to see what’s in front of you. You want great kids? Don’t hit them. You say you don’t hit them… then only yell at them if they are in mortal danger. You want a great marriage? Then make eye contact when you talk. You want…

At a Glance: The Problem with Buy and Hold

You have probably heard me rail against the Buy and Hold investment strategy. But if you think about it, in many ways it’s a pretty amazing strategy. There is only one big problem with it. And that’s what I talk about in this week’s video.

The MMA of Investing

I love martial arts. I practiced Tae Kwon Do growing up and I got to take a closer look at most of the Asian Martial Arts when I lived in South East Asia in my twenties. But it wasn’t until mixed martial arts (MMA) came along that I noticed a major weakness in all the…

At a Glance: The Only Thing that Matters is What Works

I love martial arts. But there’s a debate that has gone on for a long time. Which martial art is the best? And if you just look at the culture of each you can see the weakness that each has.And the same goes for the investment world. The question is, which strategy is the best?…

Is the Next Real Estate Crash Coming?

The Obvious Is Difficult One of the two ways I approach investing is to look for the obvious. The reason I start with the obvious is because no one does. We have all been taught that investing is complicated and complex. And therefore, we are taught to overlook what is right in front of us.…